House Hacking Tax Deductions

Tax benefits Owning rental property lowers your taxable income through depreciation and mortgage interest tax deduction. Grow your wealth The revenue collected through house hacking will help you pay down your mortgage fast and then you can start working towards your next income property.

House Hacking The Ultimate Guide About Doing A House Hack Fibyrei

Costs of house maintenance.

House hacking tax deductions. Cost of rental-related services. The tax side is pretty similar on both of them in that basically the rented unit or room whatever expenses you have for that particular area you can write off 100 of it because thats 100 real estate related. Top 4 Benefits Of House hacking.

Posted about 1 month ago Hey everyone so I bought Craig Curelop book The House Hacking Strategy and Im on page 260 so sorry if this. Real Estate Finance Multi-Family 2-4 and Residential. Interest tax deductions from income.

Discover how we help our clients save thousands in taxes automate their accounting process and gro. Log in or sign up to reply 1. Some companies are getting tax deductions for paying off ransomware hackers.

Imagine what you could do if you could get your housing expenses covered and increase your disposable income by a third. Or does it change at all if your house hacking. This credit is available each year you keep the loan and live in the house purchased with the certificate.

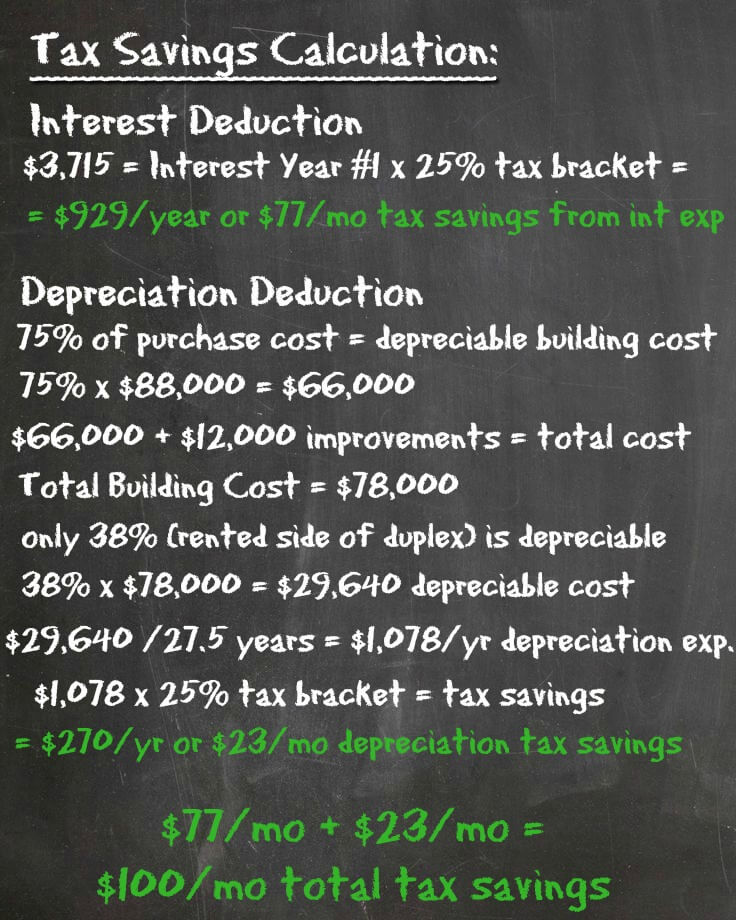

Former White House. House Hacking can save you money in the following ways. Depreciation is simply the wear and tear a property goes through over time.

House hacking gives you a variety of tax benefits. House hacking itself Ive seen it come across different arrangements from someone renting out a room to someone buying a duplex and renting out one of the units. In addition to potential lower risks house hacking can also provide many tax benefits.

Real Estate Agent from Suffolk VA. While homeownership brings many tax advantages owning an income property can also bring many tax benefits as well. Your source for all things Real Estate Accounting Tax.

Bureau of Labor Statistics the average American household currently spends close to 20000 or 33 of their annual income on housing-related costs. The maximum credit is 2000 per year if the certificate credit rate is over 20. Lowering your taxable income base.

The tax-free benefit provided by the federal government is that you can exclude up to 250000 gain on your primary residence if youve lived there for two out of the most recent five years. House Hack Tax Deductions. Mortgage interest tax deductions from income.

Certain tax benefits might include. Receiving a property tax bill for your Ohio home is almost as painful as watching the Wolverines trounce the Buckeyes. As you know your home is subject to local property taxes.

House hacking reduces your taxable income. House Hacking investors benefit most through depreciation and a mortgage interest tax deduction. The credit is subtracted dollar for dollar from the income tax owed.

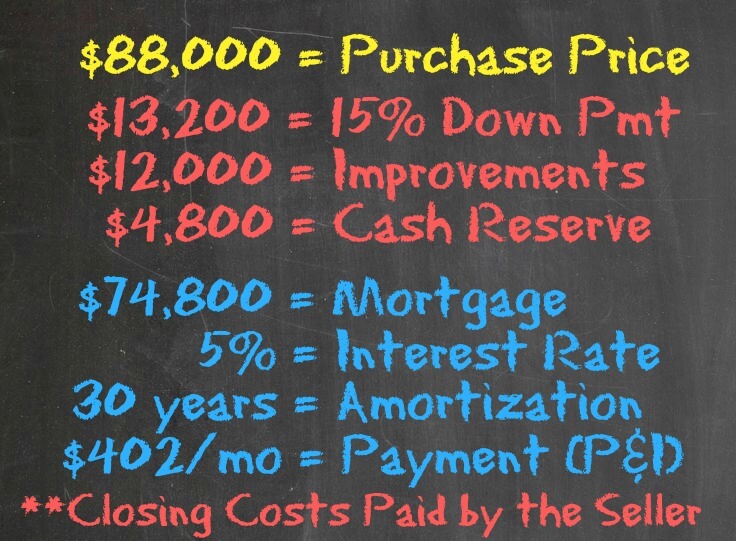

If you are married then you can exclude the first 500000 of gain from your taxes. Lowering your monthly housing allowance through generating revenue renting out portions of your property. 7031 Koll Center Pkwy Pleasanton CA 94566.

This doesnt change if you are house hacking a single-family home. You can enjoy benefits that include. In other words owning a property gives you a mortgage interest deduction saving you a significant amount.

Depreciation deduction from income. 1 day agoBut they could help hacking conflicts from escalating out of control the lead author says. Because this wear and tear decreases the value of a property investors can save a lot of money in taxes with depreciation.

First you would apply to your state or local government for an actual certificate. According to the Consumer Expenditure Survey conducted by the US. How to Get Started with House Hacking in 2021.

How To Live For Free By House Hacking

House Hacking And Taxes With Amanda Han Fibyrei

House Hacking 101 A Guide For Getting To Financial Freedom

House Hacking The Ultimate Guide About Doing A House Hack Fibyrei

How To Buy A Triplex A Step By Step Guide To House Hacking An Investment Property In The Nyc Area Famvestor

Living With Roommates To Save Money House Hack

The Ultimate Guide To House Hacking For Investors Free Investor Guide

Read The House Hacking Strategy Online By Craig Curelop Books

Passive Income With Benefits House Hacking Nomadic Real Estate

The Ultimate Guide To House Hacking For Investors Free Investor Guide

The Ultimate Guide To House Hacking For Investors Free Investor Guide

What Is House Hacking A Beginners Guide The Money Boy

7 Benefits Of House Hacking Investing With A House Hack

The Ultimate Battle Of Housing Dream Home Vs House Hacking

The Ultimate Battle Of Housing Dream Home Vs House Hacking

3 House Hacking The Tax Side To Living For Free Youtube

The Ultimate Guide To House Hacking For Investors Free Investor Guide

Post a Comment for "House Hacking Tax Deductions"