House Affordability Calculator Net Income

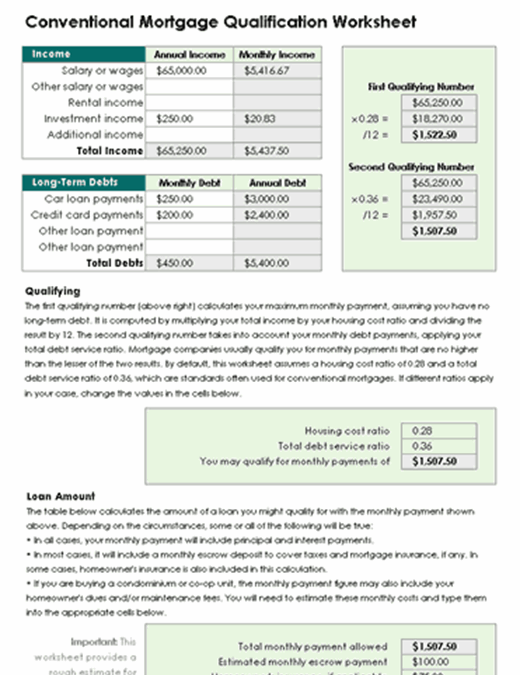

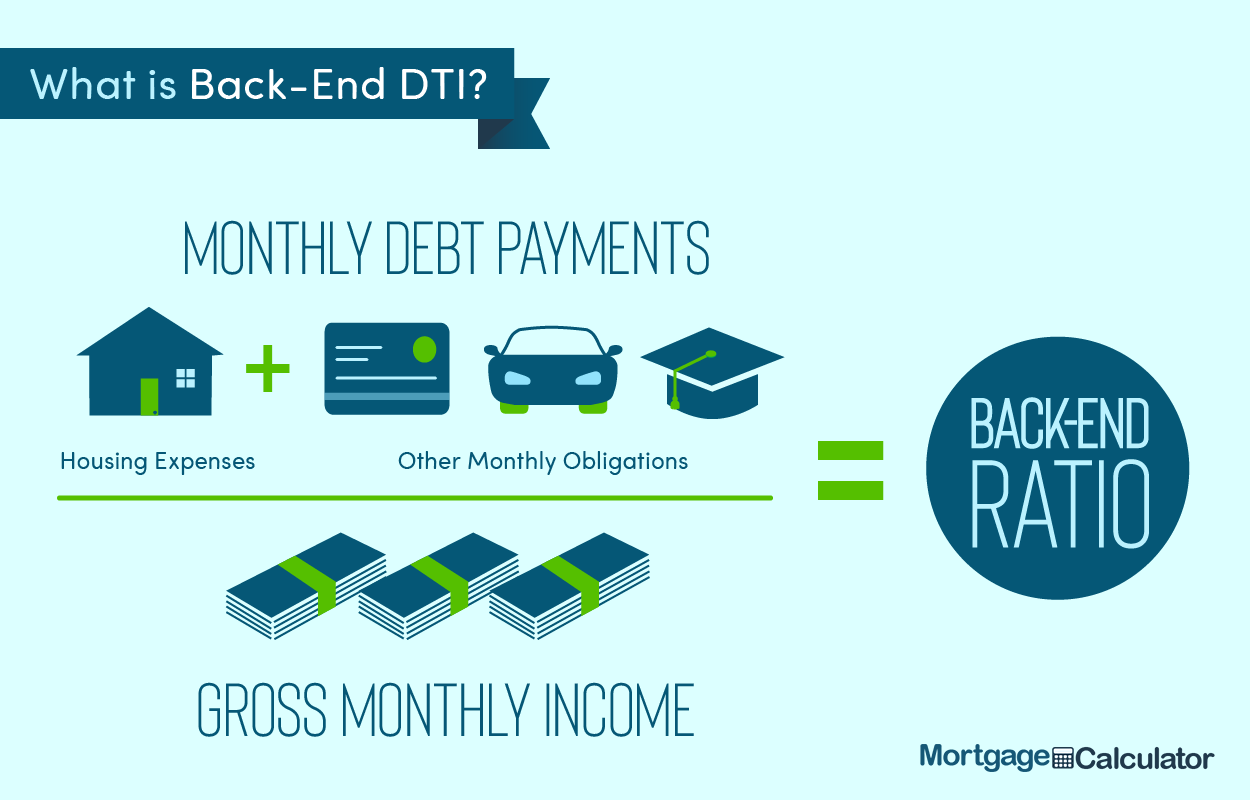

The debt-to-income ratio DTI is your minimum. To calculate your DTI ratio take your total debt amount and divide it by your gross income including taxes.

Home Ownership Expense Calculator What Can You Afford

To calculate how much 28 percent of.

House affordability calculator net income. Look at it this way. Input your net after tax income and the calculator will display rentals up to 40 of your estimated gross income. The debt-to-income ratio DTI used.

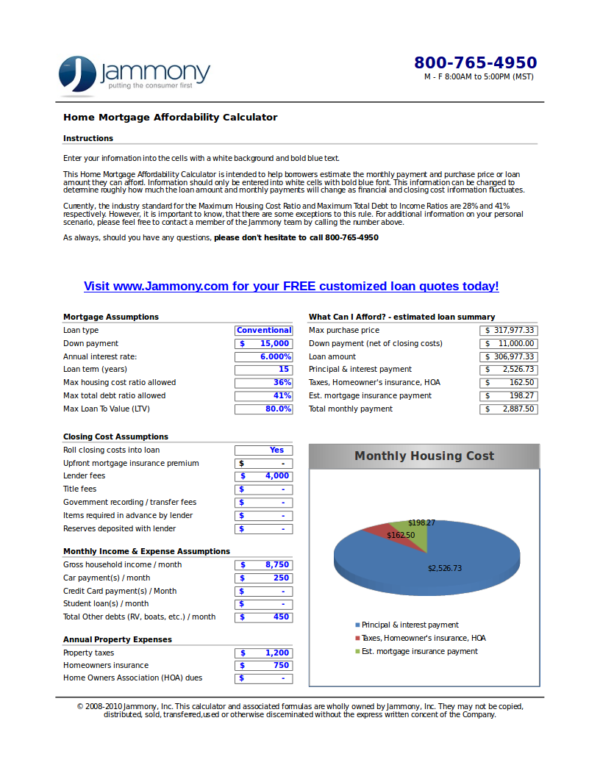

How much house can I afford. The mandatory insurance to protect your lenders investment of 80 or more of the homes value. Most lenders want your DTI to be under 36 percent.

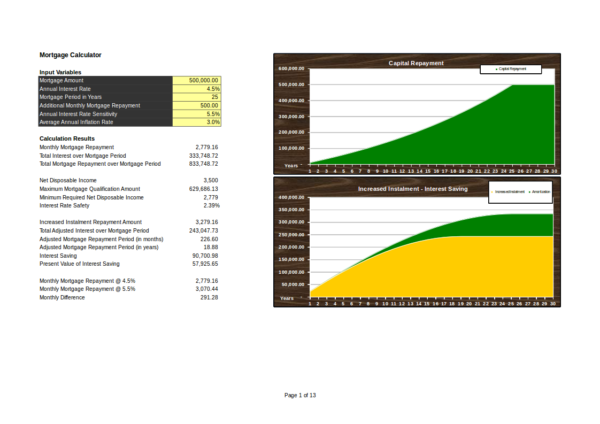

Multiply it by 25 to get your maximum mortgage payment. Debt-to-income affects how much you can borrow. Buying a home is a major commitment and many factors determine what a mortgage lender is willing to offer you.

The amount of money you borrowed. Your net monthly income is your realistic income. CMHC is not be liable for loss or damage of any kind arising from the use of this tool.

Use Bank of Americas mortgage affordability calculator to help determine how much house you can comfortably afford. Property managers typically use gross income to qualify applicants so the tool assumes your net income is taxed at 25. Youll need more income for a more expensive home.

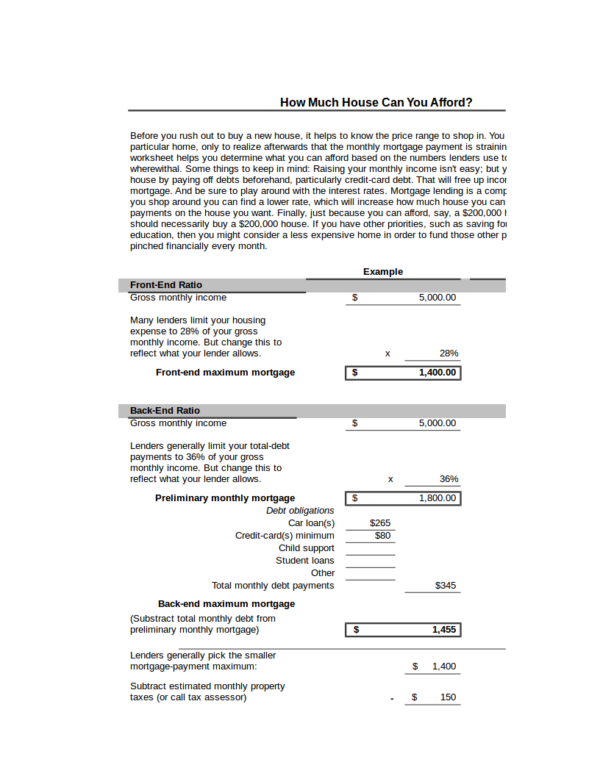

The cost of the loan. For example if your debt is 4000 per month and your monthly gross income is 12000 your DTI is 4000 12000 or 33 percent. A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

While every effort is made to keep this tool up-to-date CMHC does not guarantee the accuracy reliability or completeness of any information or calculations provided by this calculator. The calculator below will show you a ballpark figure for how much house you can afford based on your down payment amount and maximum house payment. Our mortgage affordability calculator above can help determine a comfortable mortgage payment for you.

The monthly cost of property taxes HOA dues and homeowners insurance. Actual tax rates vary. When you apply for a mortgage loan your lender will rely on your gross monthly income to determine how many mortgage dollars to lend to you.

If you earn 5000 a month that means your monthly house payment should be no more than 1250. This is known as the 2836 rule. This calculator is for illustrative purposes only.

Under Dave Ramseys guidelines youd need a monthly net income of 11924 143088 annually in order to afford a monthly mortgage payment of 2981. If you look closely one of the biggest differences between the two examples is the mortgage rate. You can afford a home up to.

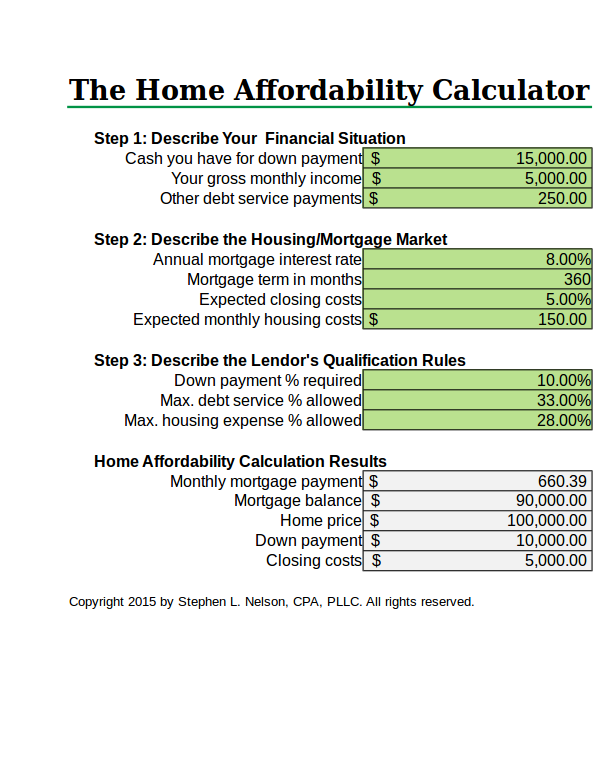

The home affordability calculator is designed to suggest a conservative sales price you can afford. The traditional monthly mortgage payment calculation includes. Financial planners recommend spending no more than 36 on total debt including a mortgage payment and no more than 28 on mortgage payments each month.

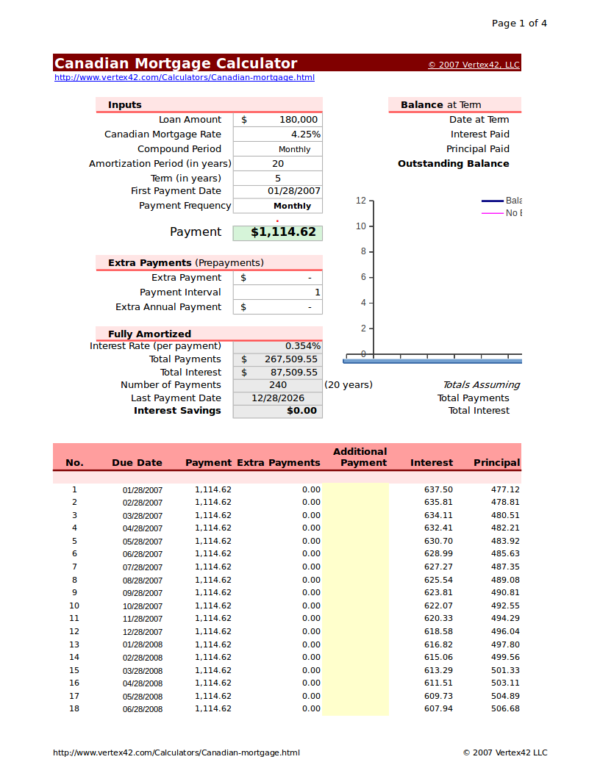

This is how much money you are. Quickly find the maximum home price within your price range. Multiply the years of your loan by 12 months.

Enter your income expenses and debt to see what a possible mortgage payment looks like. To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. The 2836 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

This estimate will give you a brief overview of what you can afford when considering buying a house. You can find this by multiplying your income by 28 then dividing that by 100. This doesnt mean though that you should rely on gross income to determine how much of a house payment you can comfortably afford each month.

Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. How does debt to income ratio impact affordability. Our home affordability calculator estimates how much home you can afford by considering where you live what your annual income is how much you have saved for a down payment and what your monthly debts or spending looks like.

Home Affordability Calculator For Excel

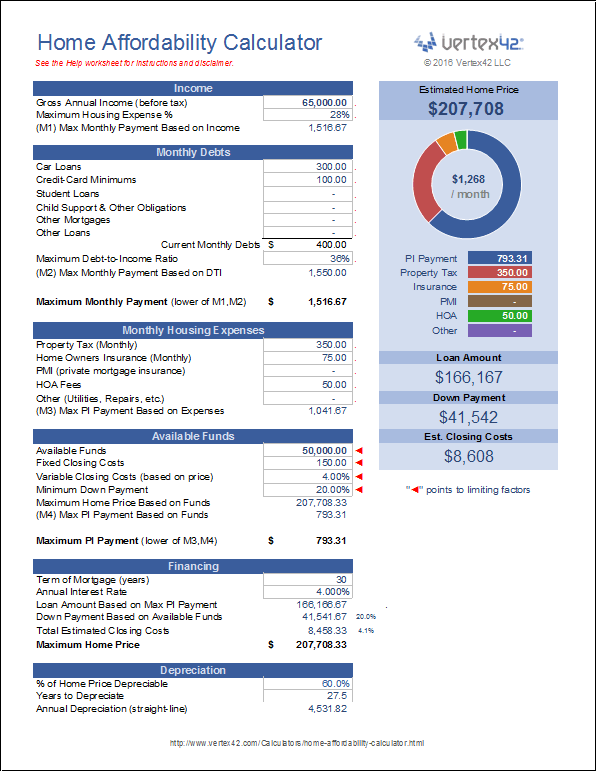

Free 9 Home Affordability Calculator Samples And Templates In Excel

Home Affordability Calculator For Excel

Free 9 Home Affordability Calculator Samples And Templates In Excel

Free 9 Home Affordability Calculator Samples And Templates In Excel

Mortgage Calculator How Much Home Can I Afford Mortgage Affordability Calculator Calculate You Mortgage Payment Calculator Free Mortgage Calculator Mortgage

Schedule C Income Mortgagemark Com

Free 9 Home Affordability Calculator Samples And Templates In Excel

How Much Mortgage Can I Afford Zillow

Mortgage Qualification Worksheet

How Much House Can I Afford This Mortgage Affordability Calculator Tells You June 2021 Millennial Homeowner

How Much House Can I Afford Bhhs Fox Roach

Free 9 Home Affordability Calculator Samples And Templates In Excel

Mortgage Affordability Calculator Interactive Hauseit Nyc

Mortgage Calculator Free Collection Of Financial Calculators In Excel Including Mortgage P Mortgage Amortization Refinance Mortgage Mortgage Loan Calculator

How Much House Can I Afford This Mortgage Affordability Calculator Tells You June 2021 Millennial Homeowner

How Much House Can I Afford This Mortgage Affordability Calculator Tells You June 2021 Millennial Homeowner

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Post a Comment for "House Affordability Calculator Net Income"