Mortgage Affordability Calculator Canada

1281000 Includes mortgage default insurance premium of 669302 For the purposes of this tool the default insurance premium figure is based on a premium rate of 40 of the mortgage amount which is the rate applicable to a loan-to-value ratio of 9001 9500. The Canada Life Assurance Company is a federally regulated life insurance company and the mortgagee.

Mortgage Calculator Zillows Mortgage Affordability Calculator Mortgage Lo Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

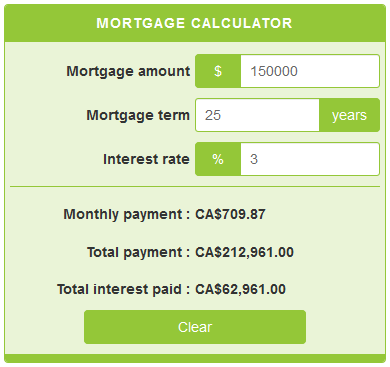

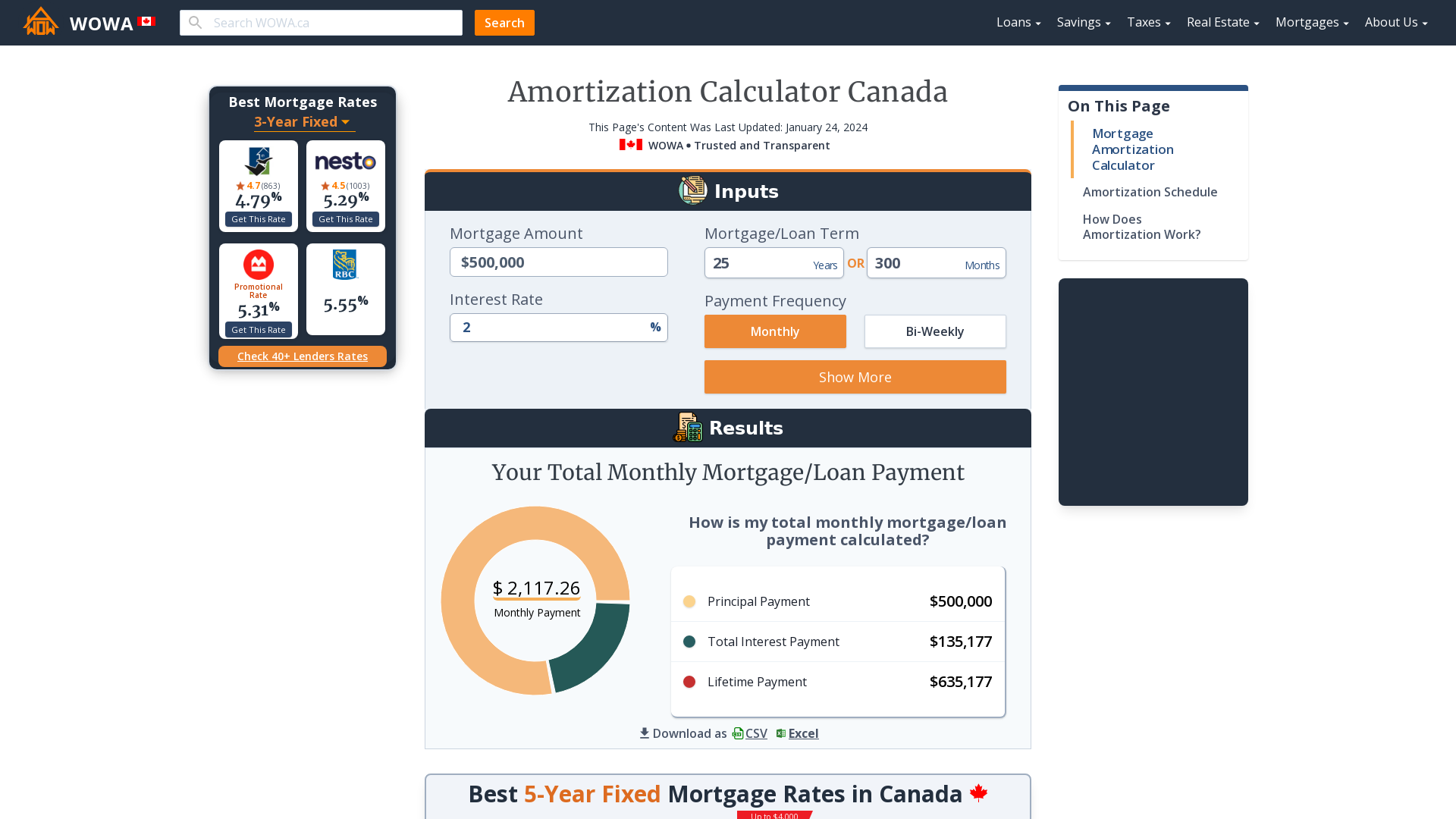

Our mortgage calculators can help you discover the estimated amount for your monthly mortgage payments based on the mortgage.

Mortgage affordability calculator canada. For homes that cost over 1000000 the minimum down payment is 20. Combined amount of income the borrowers receive before taxes and other deductions in one year. Enter a value between 001 and 25.

A total mortgage amount of. Term and Interest rate. No need to worry about that.

Mortgage Stress Test Rates Rising to 525 Effective June 1st 2021 New Stress Test Rate for Uninsured MortgagesThe higher of 525 and your mortgage rate 2. Inquiries will be referred to a Credit Planning Consultant. Use ourTD mortgage calculators to calculate your mortgage payments.

Enter a value between 0 and 5000000. While every effort is made to keep this tool up-to-date CMHC does not guarantee the accuracy reliability or completeness of any information or calculations provided by this calculator. Calculate how much I can borrow.

For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the first 500000 plus 10 of the remaining balance. This calculator is for illustrative purposes only. But in order to avoid paying mortgage default insurance premiums you must have at least a 20 down payment.

The mortgage stress test takes into consideration the mortgage amount interest rate amortization period income housing costs and debt obligations to determine your ability to afford a mortgage. The minimum down payment when buying a home in Canada is 5 of the purchase price for a home valued at 500000 or less and 10 for the portion of the purchase price above 500000. For an accurate assessment please complete a pre-approval.

For down payments of less than 20 home buyers are required to purchase mortgage default insurance. Two debt ratios are used in the stress test and you must meet a. Mortgage Qualifier Tool From Financial Consumer Agency of Canada This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses.

The calculator can estimate your living expenses if you dont know them. Your down payment can limit the above amount in various ways. Canada Mortgage Qualification Calculator The first steps in buying a house are ensuring you can afford to pay at least 5 of the purchase price of the home as a down payment and determining your budget.

CMHC is not be liable for loss or damage of any kind arising from the use of this tool. This calculator steps you through the process of finding out how much you can borrow. To qualify for a mortgage loan at a bank you will need to pass a stress test.

How Much Do You Need for a Down Payment in Canada. To use our mortgage affordability calculator simply enter you and your partners income or your co-applicants income as well as your living costs and debt payments. The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments.

A longer amortization reduces the amount of the mortgage payment but increases the total. Before shopping for a new home use this Canadian mortgage affordability calculator to determine your maximum purchase price. If your purchase price is between 500000 and 1000000 your minimum down payment is 5 of the first 500000 and 10 of the price between 500000 and 1000000.

We estimate you could afford a home worth up to. Any changes you make gives your results in real-time. The cost typically varies between 06 and 4 of your mortgage amount.

Simply the most comprehensive affordability calculator in Canada. How long it will take to repay the mortgage in full. This is the purchase price minus your down payment.

The calculator helps determine how much you can afford based on your yearly incomealong with the income of anyone else purchasing a home with you and your monthly expenses. Simply enter your monthly income expenses and specified mortgage rate. Comprehensive and accurate this affordability calculator takes into account the latest and most up-to-date Canadian mortgage rules.

For the Variable Rate Mortgage product the interest payable is based on the contract rate linked to Our Prime mortgage rate which is subject to change at any time. The above calculation is a rough estimate based on your income and the Government of Canadas 5-year stress test rate necessary for qualifying. We created our affordability calculator to help you understand your budget from the moment you start looking for a home.

If your down payment is less than 20 of your home price youll need mortgage default insurance. This is how much youll need to. Choose a term and interest rate that best suits your needs and your timeline.

To help answer this our Mortgage Affordability Calculator is a great starting point. In order to be approved for a mortgage you will need at least 5 of the purchase price as a down payment if your purchase price is within 500000. Choose between loan terms of 15- 20- and 30- year mortgages and see your estimated home price loan amount down payment and monthly mortgage payments change.

With these numbers youll be able to calculate how much you can afford to borrow. Use our tools to find the best mortgage solution that works for you and compare options.

Can I Afford To Buy A Home Mortgage Affordability Calculator

Mortgage Calculator Calculatorscanada Ca

What You Need To Know About Mortgage Down Payments Huffpost Canada Business

Mortgage Calculator How Much House Can You Afford Finder Com

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Home Affordability Calculator For Excel

Home Affordability Calculator For Excel

Home Ownership Expense Calculator What Can You Afford

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Downloadable Free Mortgage Calculator Tool

How Much Mortgage Can I Afford Zillow

First And Second Mortgage Calculator Mls Mortgage Mortgage Refinance Calculator Second Mortgage Mortgage Amortization Calculator

Free Financial Calculators For Excel

Mortgage Affordability Calculator Based On New Cmhc 2021 Rules Wowa Ca

Canadian Mortgage Affordability Calculator Canada Home Loan Income Qualification Tool

Here S How Much House You Can Afford Under Canada S New Mortgage Rules Huffpost Canada Business

Mortgage Affordability Calculator 2021

Post a Comment for "Mortgage Affordability Calculator Canada"